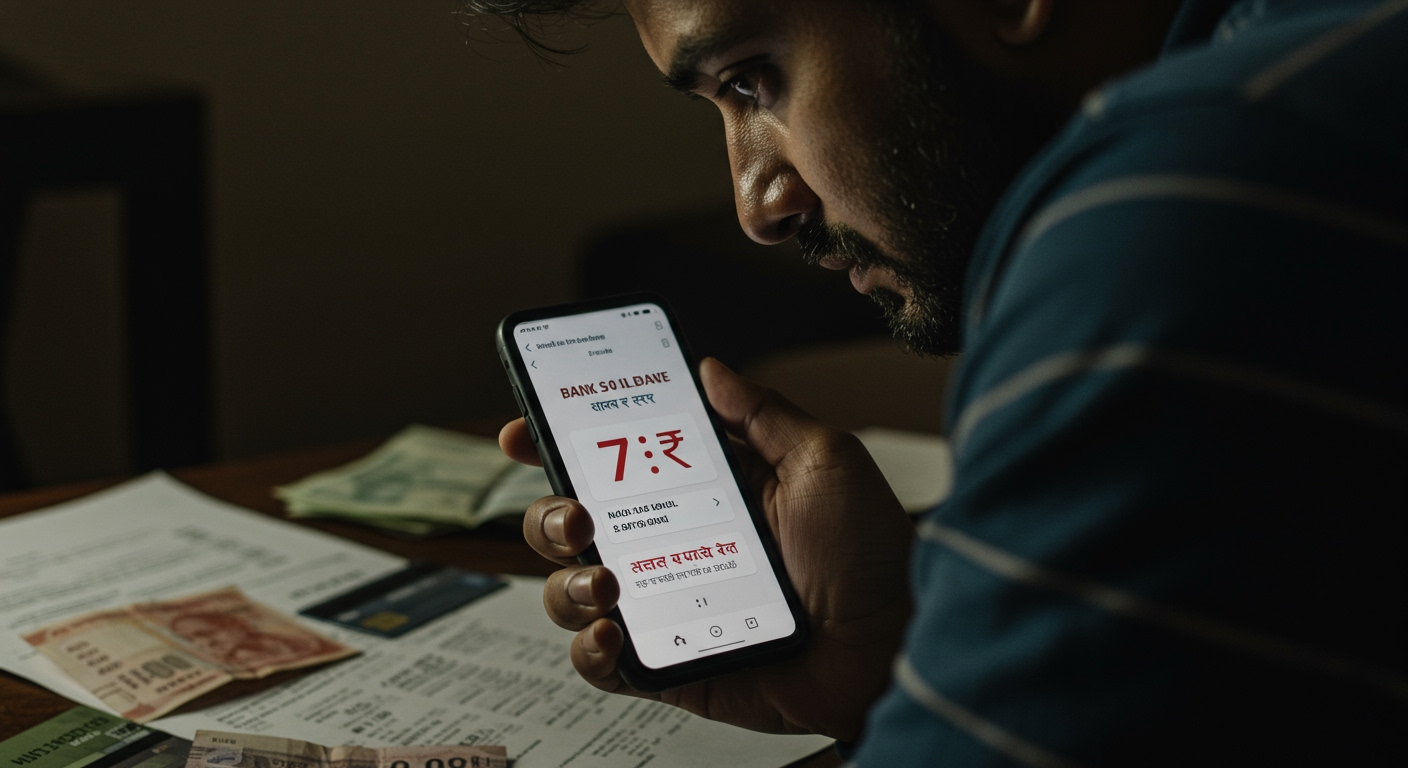

A recent viral online post has brought the stark reality of urban India’s growing debt crisis into sharp focus. A salaried individual, sharing their experience on Reddit, detailed how their bank balance plummeted from a seemingly stable ₹43,000 to a mere ₹7 in just five minutes after accounting for essential monthly outgoings including rent, Equated Monthly Installments (EMIs), credit card payments, and various overdue bills.

This highly shared personal account is widely seen as a visceral snapshot of a significant segment of the urban Indian workforce increasingly trapped in an “EMI-first,” paycheck-dependent lifestyle. The incident underscores the fragility of financial stability for many, where a month’s earnings are often precariously balanced against a heavy burden of recurring debt obligations.

The Personal Reality of Debt

The Redditor’s experience, while specific, resonates with the financial pressures faced by countless urban residents. The rapid depletion of their bank account illustrates how quickly available funds are consumed by fixed commitments like rent and loan repayments. EMIs, which represent scheduled payments towards personal loans, auto loans, home loans, or consumer durable financing, along with credit card bills and other outstanding dues, collectively absorb a significant portion of monthly income, leaving minimal buffer for unforeseen expenses or savings.

This situation exemplifies a lifestyle where a large portion of one’s salary is earmarked for debt servicing even before it is fully received, making financial flexibility a distant dream for many.

Underlying Causes of the Trend

Financial analysts point to several converging factors that have contributed to this pervasive debt landscape among urban Indians. The proliferation of easy digital credit access through various apps and platforms has lowered barriers to borrowing, making instant loans and credit lines readily available. This ease, however, often encourages borrowing for non-essential consumption.

Simultaneously, stagnant wages in many sectors have failed to keep pace with the rising cost of living, particularly in urban centers, pushing individuals to rely on credit to bridge the gap. Furthermore, spending heavily influenced by the desire for social status – maintaining certain lifestyle standards, owning specific goods, or participating in social activities – frequently necessitates borrowing, exacerbating debt levels.

The Macroeconomic Picture

The personal anecdotes align with worrying national financial indicators. According to recent data, India’s total household debt stands at a significant 41.9% of its Gross Domestic Product (GDP). Critically, over half of this debt is linked to consumption-oriented avenues such as credit cards, personal loans, and increasingly popular “buy now, pay later” (BNPL) schemes. This suggests that a substantial portion of borrowing is directed towards immediate consumption rather than investments that could build long-term wealth or productive assets.

The per capita debt in India has now reached an average of approximately ₹4.8 lakh, a figure that highlights the widespread nature of financial leverage across the population. Compounding this concern, national household savings have concurrently plummeted to a 47-year low, indicating that individuals are not only borrowing more but are also setting aside less for the future, retirement, or emergencies.

Expert Perspectives

Economist RP Gupta characterized the current situation as a “ticking time bomb,” warning of its potential to significantly slow consumption-led economic growth – a key driver of India’s economy – and further exacerbate existing socioeconomic inequality. The burden of debt can restrict household spending on non-essential goods and services, dampening overall demand.

Data scientist Monish Gosar offered a pointed perspective on the dynamics of this debt accumulation. He commented, “Banks didn’t trap us—they offered the rope. We tied the knots.” This statement suggests a view that while financial institutions provide the means to borrow, individual financial decisions and behaviors play a crucial role in the extent of debt accumulation. It prompts reflection on the balance between accessible credit opportunities and personal financial literacy and discipline.

Consequences and Outlook

The combination of easy credit, wage stagnation, aspirational spending, and declining savings paints a concerning picture for the financial resilience of urban Indians. The high levels of consumption-driven debt, as highlighted by the national figures and individual accounts like the viral Reddit post, pose risks not only to individual financial well-being but also to broader economic stability.

Should economic conditions tighten or interest rates rise significantly, the ability of a large segment of the population to service this debt could be severely tested, potentially leading to defaults and wider financial distress. The viral account serves as a potent reminder of the precarious financial tightrope many urban residents walk daily.